Payments

Accept online payments with a trusted payment gateway provider

Start accepting internet payment for websites - SecurePay is a flexible and secure online payment gateway solution 1.

Payment gateway pricing to accept online card payments

No regular, setup or hidden fees - SecurePay uses a straightforward per-transaction pricing model enabling you to accept online payments.

Standard

1.6% +

$0.30 AUD

Domestic cards

3.4% +

$0.30 AUD

International cards

No monthly fees

No annual fees

No setup fees

No additional fees for Amex, Diners or Apple Pay

Standard $25 chargeback fee

Custom

Generating more than $1 million in annual revenue?

Working in the Government, Education or Charity sectors?

You may be eligible for:

Tailored pricing

Dedicated support

Account management

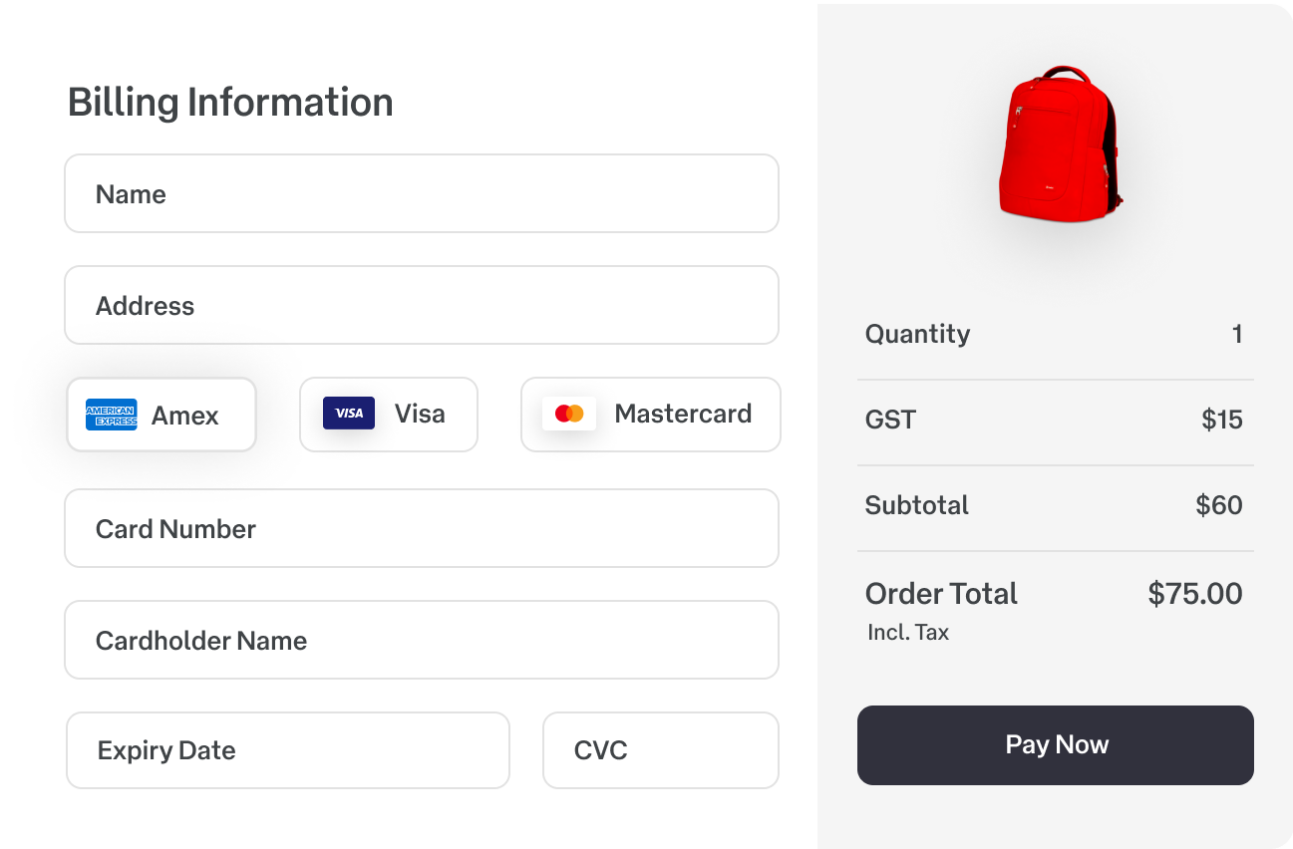

Accept online payments easily

Use our online payment solutions to accept payments for your e-commerce store or online business. Access detailed reports and local support for everyday transactions.

Accepting Australian card payments

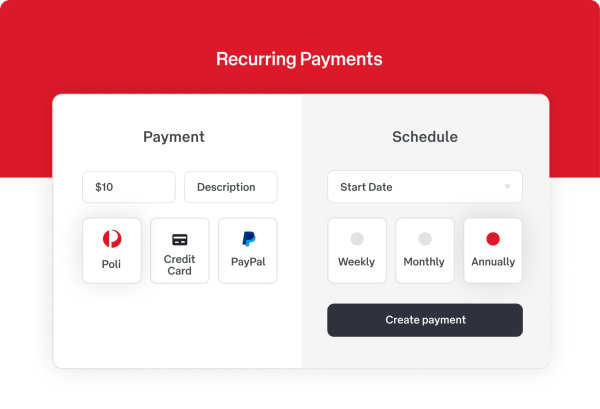

SecurePay’s internet payment gateway can also be used as a direct debit gateway or recurring payment gateway.

Start accepting credit card payments online with SecurePay!

The internet provides limitless opportunities for e-commerce stores to sell online. But before you can start taking orders from customers, you’ll need to implement a payment solution.

The convenience and security of credit cards make them the most used online payment method. In this article, we help you navigate through the online payment processing environment. We also go through how to weigh up the features and fees of the services that you can use to accept credit card payments online.

Merchant account

A merchant account is a special type of bank account, specifically designed for vendors who want to accept credit and debit cards online or in-person. The account holds the proceeds from the payment processing of credit cards. A merchant account is an agreement between a retailer, a merchant bank and payment processor for the settlement of card transactions.

Payment gateways

An online payment gateway is basically an interface that works with a business's website and the service provider's servers and networks. It connects both these entities together, enabling the business to accept payments through their website in a secure and safe manner. In a sense, it’s the online equivalent to the card reader you might use to accept in-store payments.

Some payment gateway providers offer their own merchant accounts services. Other payment gateways can be linked with your own merchant account.

Either way, you'll need a payment gateway to start accepting online card payments. An internet payment gateway is simply the code that links your webshop with your credit card. The payment can then be processed into your chosen online payment account.

What are the most common payment gateway services in Australia?

There is a wide range of payment gateway providers, each with their own benefits, features and pricing options. It’s a good idea to compare a few options based on your specific business needs.

Some payment gateway providers offer complete packages, including a merchant account. At SecurePay, we offer both a combined package that includes a complete package as well as a simple payment gateway you can use with your existing merchant account.

Other online payment services that let customers pay with credit cards online

Besides accepting card payments online, there are several other payment options you might want to consider. Many merchant accounts and payment gateways are compatible with these payment options but not all of them are.

Direct debit services.

If you’re running a subscription service or charging ongoing fees, you may want to consider a recurring payment service, such as direct debits. Direct debits are a tactic to save money, time, retain more customers and turn your inconsistent cash flow into predictable revenue.

Mobile payment options.

The popularity of mobile payment platforms such as Apple Pay and Google Pay is rising. These payment options can add another layer of security for your customers.

Phone payments (IVR).

Despite the multitude of advancements in online payment technology, paying by phone is still the preferred method for many potential customers.

At SecurePay, we accept a wide range of payment methods, giving your customers the flexibility to pay how they like.

What fees will apply when I accept credit card payments online?

Generally, you’ll have three main types of fees to pay: set-up fees, account fees and payment processing fees.

1. Set-up fees

Some online payment providers will charge you a one-off set-up fee to install the payment gateway or account. The fee usually depends on factors such as the expected online payment volume and the size of your business.

2. Account fees

The account fees you’ll pay are usually monthly or yearly charges that are set at a fixed rate. In line with the set-up fee, account fees depend on the estimated number of payments and specific features of the service.

3. Payment processing fees

Most online credit card payment services charge fees as a percentage of each transaction. Some also charge a fixed fee per transaction. Unlike set-up and account fees, payment processing fees depend on the number of purchases made.

If you take a low volume of online payments, then you should try to avoid monthly fees and high set-up fees. If you have a high volume, the transaction costs will make up the biggest part of your payment fees.

At SecurePay, we use a straightforward and affordable per-transaction pricing model. We charge 1.6% plus a fixed-fee of $0.30 per transaction made with a domestic card.

How to compare online credit card payment options

If you're shopping around for payment solutions, make sure to consider the following factors.

Fees.

Obviously, fees are one of the most important factors to consider. Take into account all set-up, account and payment fees, along with your estimated online sales.

Set-up process.

Obtaining a payment service provider can still be a long and complex process, particularly if you are a new or small business going through the process for the first time. Generally, the complete package options that are offered by payment providers will be the fastest to set up.

Support services.

Make sure you weigh up the support services available. Knowledge about the local market and support are factors to consider.

Reporting.

To help keep your accounts team happy, a simple and easy-to-navigate dashboard is preferable. At SecurePay, we make it easy to track all your transactions, set date ranges and search specific payments.

Website compatibility.

Most online payment services are compatible with e-commerce providers. The integration of the payment process with the user experience of the website is also important. So a smooth integration will benefit the customer experience and the conversion of your website.

Most often, spending the time to compare different providers will help you find the payment solution that is right for your business and your customers.

A product of Australia Post - SecurePay is there to help you accept online payments and to answer all of your questions about payment solutions, including direct payment and iframe payment gateways. SecurePay is a flexible, easy to integrate and secure ecommerce payment gateway provider.

1 NAB provides the merchant banking services, which includes the authorisation, processing and settling of the cardholder's card transactions to the merchant.

This information is provided for general information purposes only and is not intended to be specific advice for your business needs.